Automatic Trading Systems in sports betting and stock exchange operations

Among fans of American roulette, there are two types of players: those who bet with their hearts on the first number that crosses their minds, and those who, in order to win, study and practice gaming systems, sketching out complicated strategies and searching for the perfect algorithms. Among the latter there is a sub-group whose members program roulette computer simulators to control the anxiety that causes them to have an idea for a winning method but not to have a casino nearby to put it in practice (that is just me.)

Gambling has always been a fundamental activity for human beings throughout their emotional and cognitive lives, as it makes social development possible and allows the learning of social roles and behaviors. Moreover, research shows that people feel attracted by risk and the possibility of somehow knowing the laws that govern it in order to dominate ‘chance’. This attraction is made particularly clear with betting.

There is a word that refers to a game as an entertainment activity: play. An entirely different word refers to the activity in which one risks something in exchange for the possibility of obtaining a profit: gambling.

Throughout history we have known plenty of recreational games related to betting. Many of them still practiced today, like dice and card games, or sporting events. Although new versions of games continuously appear, the Internet has made possible qualitative changes in the world of gambling. The changes are derived from the features of the Internet itself, such as its accessibility, immediacy and universality. The intrinsic characteristics of the Internet can turn a calm entomology fan with savings into a compulsive daily reader of sporting and economic newspapers, tirelessly in search of the magical statistical pattern that will make him win enough money to dedicate body and soul to his interest in insects.

Gambling can be an entertainment activity or it can become a serious problem for the people who practice it. When gambling is not fun anymore but turns into an addiction, it becomes a pathology. Gaming regulators are more or less sensitive to this conduct disorder, mainly due to the fact that gambling generates a lot of money for businesses that offer it. In order to balance the economic benefits with the addiction problems and/or public concern that addictive gambling behavior generates, the authorities impose a series of controls and requirements. Thus, for example, the way to display information about gambling, the prizes, how to calculate the duration of the games, means of payment, etc. are all established by regulations.

To avoid these controls and to provide gambling businesses with maximum economic benefit, the Internet has become the most suitable setting for this market. Having access to online gambling platforms allows players to choose the most convenient and least restrictive gambling venues; we are not conditioned by physical barriers and it is our option to play as much and as fast we choose. There is a single restriction in common with the traditional systems: our capital and/or our debt capacity.

Sport betting

In Spain, for a long time, the only sporting bets permitted have been football and horse racing pools. That system allows few gambling options since it is only possible to bet on a very small number of results — three, in the case of the football pools: the home team wins, there is a draw, or the away team wins. The most complex strategy for an expert of, say, the Spanish BBVA League[1], is to make double or triple bets with the consequent payments.

Mathematically, the probability of guessing 14 results correctly in the football pool is 1 in 4,782,469. That is far lower than the possibility of guessing the right numbers in the national lottery (before the share offer took place). In the ONCE draws (organized by the National Organization of Spanish blind people), the lottery offers a win probability of 1 in 100,000. The week of August 28, 2011, the 17 winners who correctly guessed 14 results obtained a prize of approximately €35,000 (the approximate amount paid for guessing the daily ticket correctly).

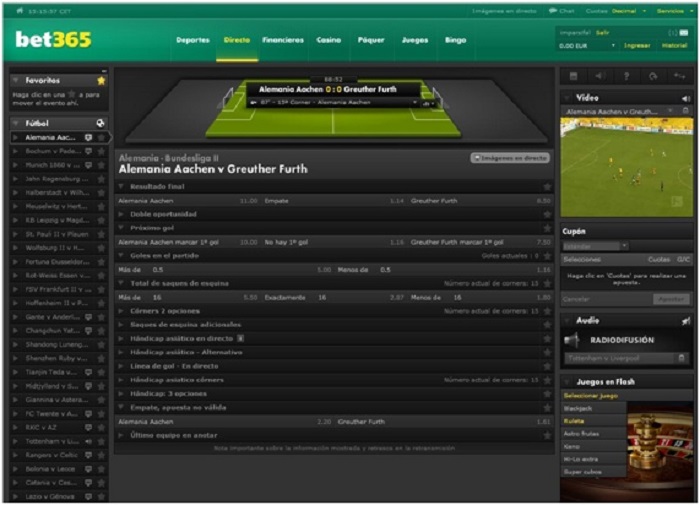

When betting online, however, the game options are countless. Not only can people bet on the famous 1-X-2 but they can also do it on the number of cards given during a game, the amount of corners or the exact result of the game — and we can do it before or even during the game. Furthermore, the options are not restricted to a particular sport or a certain country.

Similarly, we can combine bets to multiply the probable gains. We end up creating our own pool by combining bets and games. For example, we could bet that the security car will not be needed during the F1 grand prix in Singapore (4.20) and that Napoli and Villarreal will draw the next UEFA Champions League match (3.50). We could give, as a result, a multiple bet that would pay €15.16 for each euro we bet. The betting houses, like casinos, allow a maximum amount to bet; in our example €72, which potentially would have a €1091 prize. In order to bet a higher amount, this bet would have to be evaluated by one of the company’s analysts.

Trading systems

Trading is a term with which any fan of economy blogs and markets is familiar. It means to buy and sell and we normally relate it to short term operations of purchases/sales.

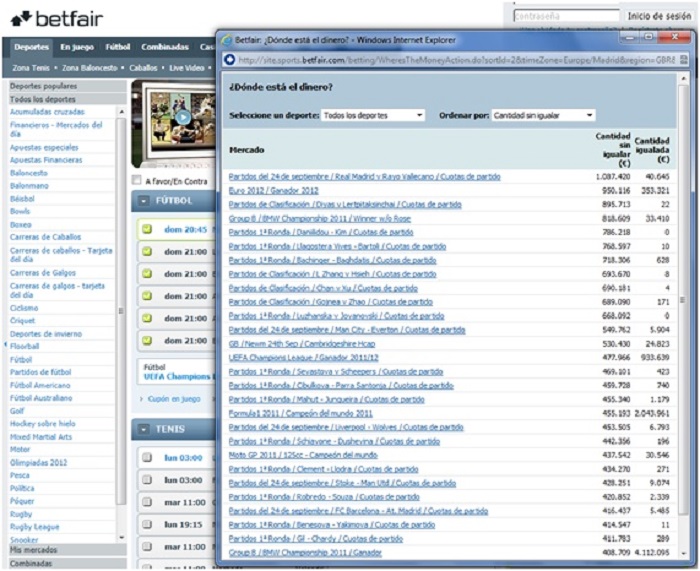

A trading system or platform is a computer program in which the processes related to trading are automated. Examples include the stock exchange product transactions (stocks, metals, currencies) or, in relation to sports betting, the systems that make it possible to bet on quotes set by other users as if they were stock exchange products. These sorts of brokerages are known as betting exchange offices. Therefore, in the betting exchange offices, one does not gamble against a broker but against other fans in exchange for a fee out of which taxes are paid in Gibraltar.

Users can bet in favor of (“back”) or against (“lay”) a certain event (for example, that Atlético beats Real Madrid or that Casey Stoner falls off his bike in a certain race). This is similar to the way a purchase (“bid”) or sale (“ask”) process is used in the financial markets.

Much like we can observe how the interest on the Greek debt grows in line with doubts about the Greek economy, we can also see how, during a football or soccer match, the prices that the betting offices pay change when one team or another has scored a goal or has had its star striker sent off. Therefore, in sports trading, the psychological factors seem the same as in financial trading, such as panic, euphoria, optimism, etc.

Markets

In these times, mass media bombards us with economic terms and pushes us to coexist with the various stock exchanges: New York, NASDAQ, Tokyo, TMX (Toronto), Deutsche Börse, BM&F Bovespa (Sao Paulo), and Ibex35 (the stock market index of the Bolsa de Madrid, Spain’s principal stock exchange). Naturally, it makes one try to comprehend a little more of this world of the stock market. This understandable interest can cause the person to end up playing the stock market and its derivatives.

Until recently, if we saved €500, we did not think of investing them in financial products. This was not only because we did not know how these products functioned, but also because the purchase and sale fees together with having to go to a bank made these operations inconvenient and hardly profitable in any respect.

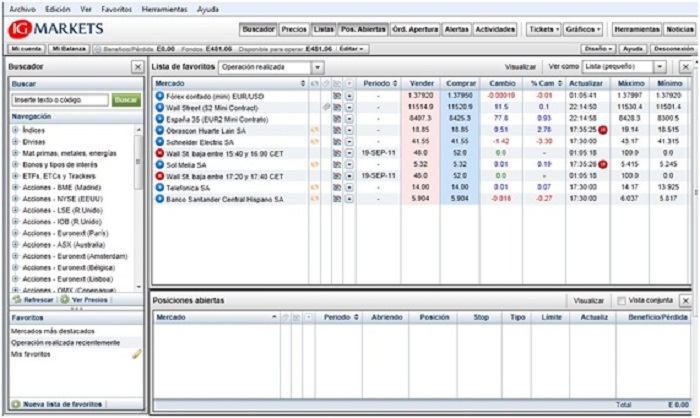

With online trading systems these difficulties disappear. Opening an account on IG Markets or X-trader is as simple as obtaining a Gmail account. Online we do not have to go anywhere, and now we do not even need to have saved money; if we «trust” a value we can “invest” with a credit card. Of course, we might be asking ourselves, what about the benefits? We have commented previously that we cannot win much with €500. Well, this is no longer true if we apply the concepts of leverage and Contracts for Difference.

A Contract for Difference (CFD) is a financial product that allows investors to participate in the price movements of securities without owning the stocks or commodities. This makes it possible to buy or sell on credit, disbursing only a small amount of the cost of the product.

Leverage is the ratio between one’s own capital and the credit invested in a financial operation. Reducing the initial capital that one has to invest, produces an increase in the obtained profitability. The increase in the leverage also increases the risks of the operation since it causes less flexibility or greater exposure to insolvency or incapacity to cover payments.

Therefore, when operating in a trading platform, our €500 becomes €5,000 as if by magic. Then, as the value of a stock changes, we can obtain profitability. All of this allows us to operate with intraday data or its equivalent: just as if we were professional brokers we can see within one hour how much we make or lose as the value of our stocks varies. It also is not necessary to pay fees for the purchase and sale of stocks; we can work with indices, commodities, or the price per square meter in London.

If we can make plenty of money due to leverage, we might at first suspect that we can lose it too, but that is not exactly so. Here we find the magic of the CFDs. At least, it is magic for the trading companies that make so much money on the basis of something so apparently innocent as not to allow us to lose.

The guaranteed stop-loss is the name of the safeguard for the small investor, who cannot assume great losses in a single payment. The guaranteed stop-loss is the maximum amount that a user of CFDs can lose in a position. (A “position” refers to the fact of having invested money in some product, betting that its price will either increase or decrease).

What is the trick? When the commodity reaches the guaranteed stop, you lose all the money, which goes to the trading office. This is illustrated in the following example.

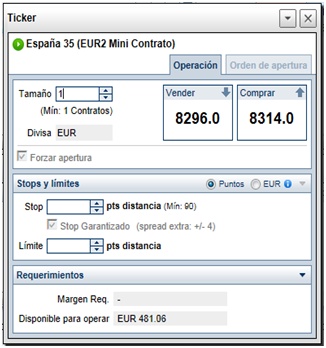

We think that the Ibex35 is going to increase today so we access the platform and find the live information of the prices of purchase and sale related to Ibex.

We think that the Ibex35 is going to increase today so we access the platform and find the live information of the prices of purchase and sale related to Ibex.

We decide to purchase a contract so that whenever the Ibex35 raises a point we will make €1 and whenever it lowers a point we will lose €1. If the Ibex rises up to 2% (that is 166 points) we will make €166.

In the stop level field we indicate how much we are willing to lose and that amount of money will be the one required by the trading office.

First, we begin losing €18 for the 18 points between the purchase price and the sale price; this is what is called the spread.

Unlike the stocks, with which one normally operates at banking institutions, when using CFDs we do not have the option of waiting to recover our investment if we make a mistake in our predictions.If we decide that our stop level is €166, in the event that the stock market oscillates 2% we will lose all the money, and, although later our index might grow by 10%, we will not receive a euro. The stock market, especially in these times of great volatility (many ongoing ups and downs), has continuous changes of intraday quotations, even if at the end of the day it has a clear upward or downward tendency.

Damn it, corpses bleed!

The famous psychiatrist Abraham Maslow tells us that once he received in his office a person who considered himself a corpse. In spite of the logical arguments of the doctor, the man persisted in his belief. In a moment of inspiration, Maslow asked his patient: “Do you believe that corpses can bleed?” To which the man replied: “That is ridiculous! It is evident that corpses cannot bleed.” After asking him for permission, the psychiatrist punctured the patient’s finger and there appeared a drop of shining red blood. The astonished patient exclaimed: “Damn it, corpses bleed!”

I hope, with this anecdote, to offer a metaphor on our beliefs; in an addict’s case, the fact that bets derived from a strategy might be winning can dominate common sense. Such a winning technique does not exist, or at least there is no mathematical demonstration of it. This is, of course, excluding the scientific works of Kevin Mitnick or the Pelayos (which I will address in an additional article) — despite their fan’s thousands of pseudoscientific attempts to discover a winning formula.

Darren Aronofsky’s debut work: Pi, faith in chaos, is very illustrative of these attempts. A very reticent mathematician, quite paranoid and suffering from severe migraines, tries to discover the mathematical model that governs the swings of the stock market, through calculations and programs that he produces on his computer.

When someone goes to play a few games of Bingo, s/he hopes to be lucky by making a gesture, sometimes as complex as a Will Smith greeting from The Fresh Prince of Bel Air, or by invoking luck with some weird amulet that perhaps comes from one of the Heechees’ lost spaceships. In Bingo there is no strategy that favors the probability of winning because the cards are not normally chosen but given to you, and although you could choose them it would be practically impossible to find a card with a specific combination between the time one game finishes and the next begins.

In the lottery something similar happens, although it is possible to buy a specific number. Supposing that a combination exists that is awarded daily (say 300 numbers per year), to go through the 100,000 numbers, we would need at least 30 years, and yet we would not have sufficient data to make a statistical analysis to evaluate future tendencies.

Therefore, we know for sure that in many games of chance the knowledge of a discipline like statistics does not offer any advantage unless it convinces us that playing is not a good idea economically. Nevertheless, there are other games in which mathematics or an in-depth knowledge of events offers a great advantage for the player who dominates the subject. Dice are an example.

Intuitively, when we play dice we can think that there is the same probability of getting a 7 as a 12 and therefore we trust our lucky number. An analysis of the different dice combinations will quickly disabuse us of that notion. It is a given that the 12 can only be obtained by combining two 6s (1/36), whereas the 7 can be obtained with the combination of 6 and 1 or 5 and 2 or 4 and 3 (6/36). It is 6 times more possible to get a 7 than a 12!

Obviously, the casinos and betting offices know these data and adapt the prizes to the type of bet so that the bank always plays with an advantage.

In financial and sports trading it seems important to know the markets or the sports trajectories of the bet elements in order to play with an advantage and to obtain profits. At this point, the conceptual difference between playing by trusting luck (like in the lottery) or by trusting knowledge becomes visible.

You only need to have a look at the advertising on the Internet to see to what extent the financial and sports trading offices are eager for clients. After a pair of seminars and a few manuals, it is simple to make them become donors of euros. It is easier to learn Klingon than to grasp the new slang that floods a beginner trader. Unless you are very bright, you can lose a lot of money while learning the oddities of each system.

Trading is currently booming. To introduce us to it there are numerous websites that reverberate or are just there to guide us in this amalgam of words and strategies. In sports betting we can find many well-meaning messages from users who share their analyses and intuitions, like those which appear in this site of strategies. In financial trading the same companies give free seminars all over the countries where they operate.

For a long time, there have been similar techniques implemented to win in roulette. We can find thousands of those pages on the Internet, most of them made available online by the same casinos that offer the roulette games. There are also many techniques to bet on the stock market or on sporting events. The difference is based on the fact that roulette has been deeply studied and there is no proven technique that helps people win. However, betting on financial markets and sports events offers so many possibilities that it cannot be demonstrated mathematically that one will end up losing, unless one concludes, motu proprio, that “the bank always wins.”

[1] The Spanish BBVA League is the National Professional Football League (soccer). It is named BBVA League for sponsorship reasons. BBVA is a multinational Spanish banking group.

Translation: Teresa Galarza

Great reading, I hope you continue writing in English. It was very interesting. «The bank always wins», so true.